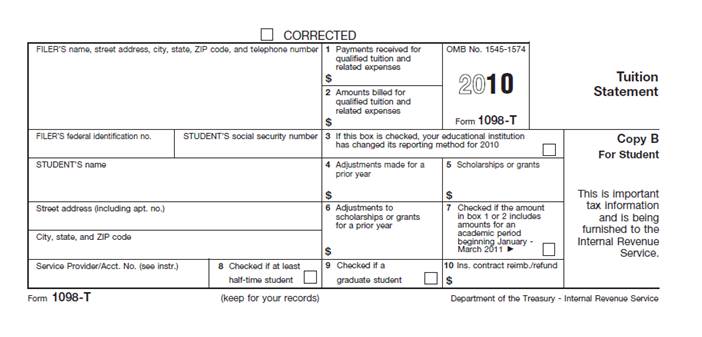

The 1098-T is an IRS form entitled “Tuition Statement” that assists students in determining if you qualify for certain education related tax credits under the Taxpayer Relief Act of 1997(TRA97).

The IRS requires eligible educational institutions such as the Institute for Shipboard Education to file a 1098-T form each year for each student (excluding non-resident alien students) enrolled (that paid us directly) for whom a reportable transaction is made during the calendar year.

Please note: Your home school is responsible for issuing your 1098-T if you made your payment directly to them and they in turn paid us.

The 1098-T will detail ONLY the tuition amount you paid and does NOT include Room and Board, textbooks, field trips etc. Any Institute Aid awarded will appear in Box 5 under Scholarships and Grants.

Please contact your tax preparer for additional information on the handling of your 1098-T.

When does my 1098-T get mailed?

The forms will be mailed by January 31 to the address listed in your MyVoyage portal. You should receive your 1098-T form within two weeks of this date. Please email finance@isevoyages.org for instructions to access this form electronically or if you have questions regarding this information.

Canadian residents should contact the Fort Collins office directly at 800-854-0195 for completion of required Canadian tax tuition reporting forms.